All Categories

Featured

Table of Contents

- – Harmony SoCal Insurance Services

- – Feeling Overwhelmed by Medicare Options? You'r...

- – Common Questions Seniors Ask When Starting

- – Voice Search Phrases Like "Best Medigap Near...

- – The "Me Too" Moment Many Experience

- – Sensory Relief in Finding Answers

- – Why Timing Matters for Your Peace of Mind

- – Understanding Medicare Supplement Basics and Gaps

- – What Medigap Covers (and What It Doesn't)

- – Key Gaps in Original Medicare

- – Standardized Plans Explained

- – Why Supplemental Coverage Provides Predictab...

- – Comparing Top Medigap Plans: Plan G vs Plan N ...

- – Detailed Benefits Breakdown

- – Plan G Advantages

- – Plan N Cost-Saving Features

- – When Plan N Makes Sense

- – California-Specific Considerations

- – Key Factors to Consider When Selecting Your Plan

- – Assessing Your Health and Travel Needs

- – Chronic Conditions and High-Risk Factors

- – Budget and Premium Stability

- – Factors Influencing Premiums

- – Leveraging California's Birthday Rule

- – Who Benefits Most

- – Enrollment Periods and Switching Plans in Cali...

- – Initial Enrollment Window

- – Guaranteed Issue Rights

- – Annual Election and Open Enrollment

- – Special Enrollment Triggers

- – The Power of California's Birthday Rule

- – Costs, Rates, and Savings Strategies

- – Average Rates in Southern California

- – Factors Influencing Premiums

- – Ways to Lower Costs

- – Long-Term Savings Tips

- – Avoiding Common Pitfalls

- – Specialized Medicare Supplement Services for U...

- – Coverage for Chronic Conditions

- – Options for Veterans and Dual-Eligible Indivi...

- – High-Risk and Guaranteed Issue Scenarios

- – Frequently Asked Questions About Medicare Supp...

- – We Can Help! Contact Us Today

- – Harmony SoCal Insurance Services

Harmony SoCal Insurance Services

2135 N Pami Circle Orange, CA 92867(714) 922-0043

Harmony SoCal Insurance Services

Figuring out how to choose the right Medicare Supplement policy for your needs starts with grasping Original Medicare's boundaries and identifying how Medigap plans successfully cover those openings. Many seniors discover that a thoughtfully selected supplemental plan transforms erratic healthcare outlays into stable, anticipated amounts, delivering enduring peace of mind when combined with Parts A and B. Medicare Supplement policies provide standardized benefits across the country, assuring uniform protection irrespective of the insurer. This consistency tackles common worries including Part B coinsurance, prolonged hospital admissions, and unforeseen foreign travel emergencies. In Southern California, residents from Orange County to San Diego benefit from seasoned local knowledge when navigating these selections.

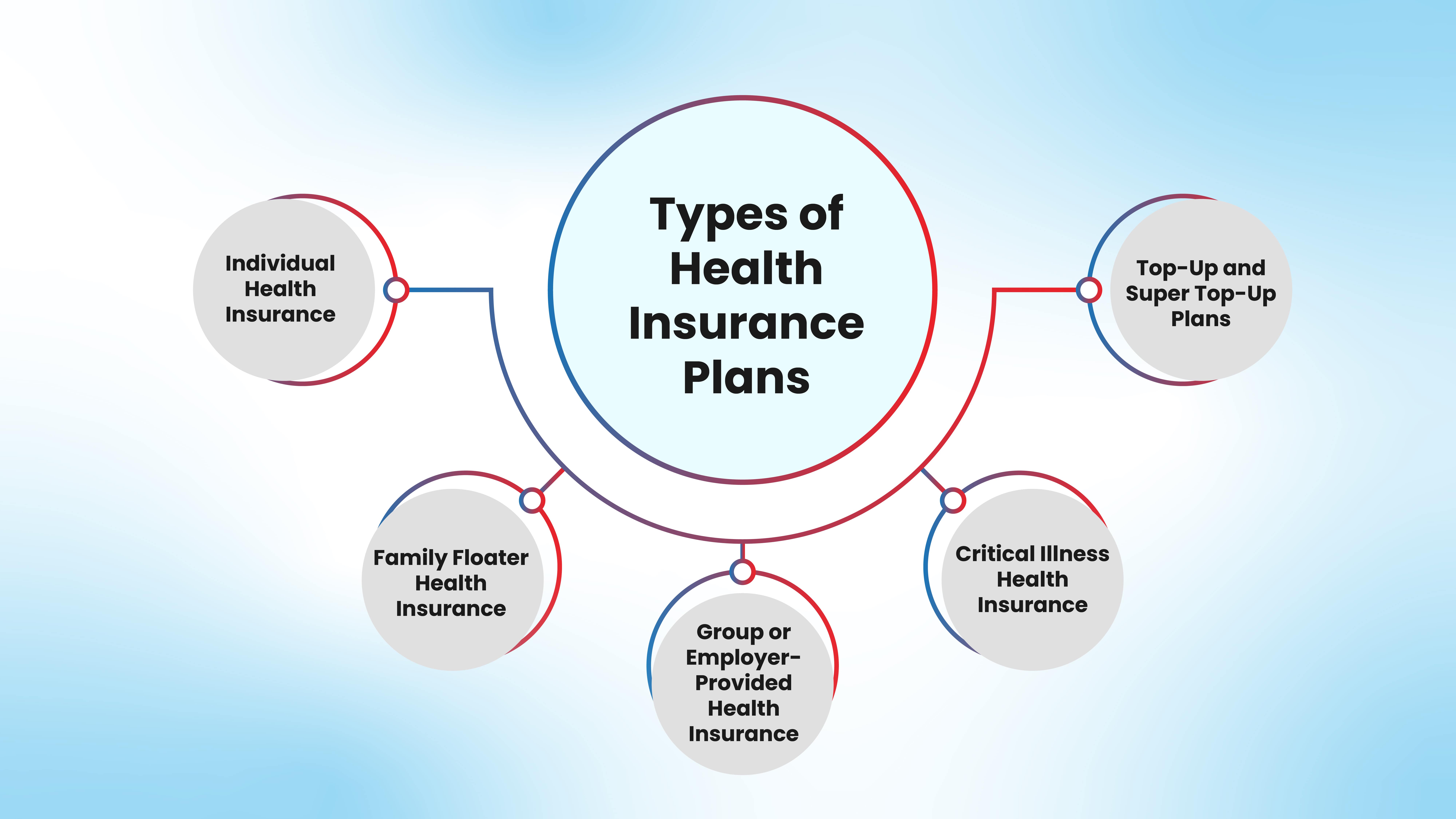

The selection involves careful consideration of individual medical habits, fiscal constraints, and daily living habits to secure perfect alignment. Designated by letters A to N, these plans furnish different coverage tiers, with Plan G and Plan N leading for their effective combination of exhaustive benefits and economical pricing. Expert carrier comparison and application of state mandates lead to optimal outcomes over time. Delve deeper into senior coverage options for further perspective.

Feeling Overwhelmed by Medicare Options? You're Not Alone

Another Medicare notice can evoke immediate concern regarding future medical costs. Numerous folks naturally question which defenses will prevent large surprise bills from disrupting retirement plans.

Throughout Southern California, individuals routinely share parallel worries while exploring Medigap possibilities in areas from Orange County to San Diego.

Typical voice search keyword phrases reveal everyday inquiries such as "leading Medicare Supplement plan close to my location" or "optimal way to select Medigap suited to my wellness profile."

These long-tail keyword phrases underscore real concerns about Original Medicare deficiencies, encompassing boundless Part B coinsurance and skilled nursing facility charges.

Residents in the Inland Empire, Riverside, San Bernardino, San Fernando, and Ventura often experience this preliminary concern.

Acknowledging that thousands confront the identical challenge often brings the first wave of relief.

Consider on how peers have moved from confusion to confidence in their protection voyage.

Common informational keyword phrases surface as enrollees pursue clarity, such as "what constitutes Medicare Supplement Insurance?" or "how Medigap operates with Original Medicare."

These thoughts validate the universality of the experience, fostering a sense of community among those starting on the path.

Transitioning from isolation to connection often marks the turning point toward empowerment.

Common Questions Seniors Ask When Starting

Precisely what defines Medicare Supplement Insurance? It comprises uniform policies designed to shoulder expenses Original Medicare partially covers.

How do these policies mesh with Original Medicare? They engage after Medicare payment, settling remaining endorsed amounts.

Which between Plan G and Plan N proves superior? Selection depends on private medical frequency and tolerance of minor copays versus premium variances.

Which enrollment phases provide supreme protection? Diverse intervals exist, bolstered by regional statutes granting amplified adaptability.

Grasping these foundational question-based keyword phrases dismantles early hurdles effectively.

Plenty ascertain that straightforward clarifications transform intricate subjects quickly.

Addressing these questions upfront hastens the path to confident action.

Many report increased confidence after resolving early uncertainties.

Voice Search Phrases Like "Best Medigap Near Me"

Day-to-day inquiries stress desire for nearby Medicare Supplement proficiency in Orange County and vicinities.

Queries often incorporate singular situations or financial caps for exact outcomes.

These patterns show robust demand for local, accessible counsel.

The "Me Too" Moment Many Experience

Hearing to counterparts describe similar starting points forges instant rapport among potential subscribers.

Long-tail dilemmas frequently encompass integrating current medical records or forthcoming itinerary arrangements.

Collective narratives build confidence that resolution awaits.

Collective tales illustrate achievable conclusions regularly.

This connection often drives forward momentum.

Sensory Relief in Finding Answers

Imagining controlled disbursements brings prompt serenity.

Organized data supplants vague concern with concrete guidance.

Clarity emerges as the primary reward.

Why Timing Matters for Your Peace of Mind

California regulations markedly lessen timing-induced strain relative to other states.

Recurring windows permit requisite modifications without fines.

Tactical scheduling averts preventable protection voids.

Proper synchronization optimizes available defenses.

Proactive awareness protects against mistakes.

This mutual foundation steers toward assured selections. Begin reviewing your schedule via our thorough process summary.

Understanding Medicare Supplement Basics and Gaps

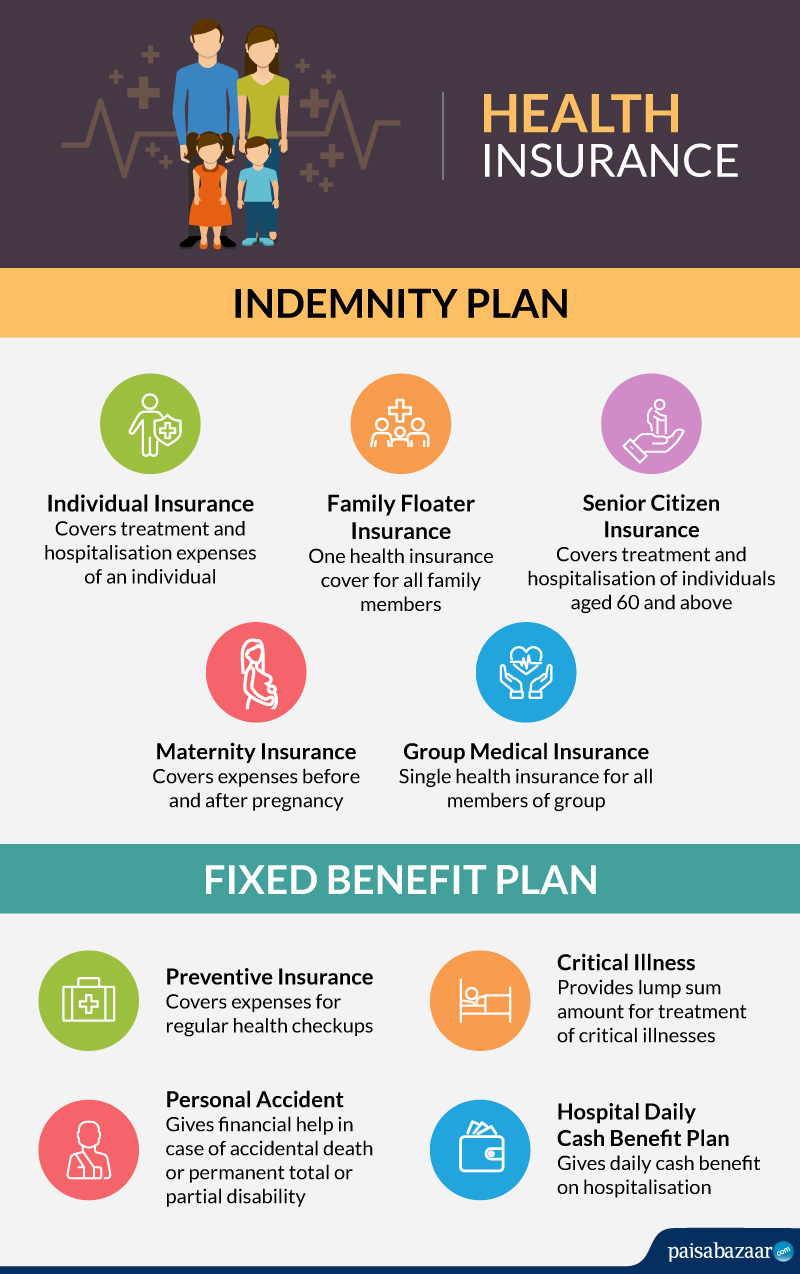

Medicare Supplement coverage serve as essential layers of defense by addressing fees Original Medicare leaves to enrollees. Standardized design ensures matching benefits irrespective of issuing carrier.

Original Medicare levies no yearly out-of-pocket ceiling, leaving participants to persistent buildup. Medigap establishes boundaries via defined coverage parameters.

The Part B deductible requires fulfillment before to additional advantages initiate. Supplemental policies frequently manage subsequent duties thereafter.

Protracted hospital sojourns generate diurnal coinsurance duties under Part A. Foremost Medigap options eliminate these burdens wholly.

Informational keyword phrases persistently focus on elucidating how Medicare Supplement rectifies these exposures methodically.

As per the Medicare.gov information hub, standardized framework warrants portability and comparability countrywide.

Skilled nursing facility attention beyond initial days amasses hefty diurnal tariffs sans supplemental support.

Foreign travel urgencies linger mostly uncovered by Original Medicare solely.

Hospice provisions entail coinsurance totals that accumulate quickly.

Blood usage beyond the first three pints strays beyond standard scope.

These voids propel legions to secure additional strata yearly.

Industry data show that supplemental adoption links with reduced financial stress among retirees.

Expert insight emphasizes the role of education in preventing expensive oversights.

Many customers recount renewed ease after matching coverage with actual risks.

Local variations in carrier options add detail to national standards.

What Medigap Covers (and What It Doesn't)

Medigap dependably pays Part B coinsurance for physician visits and outpatient treatment.

It stretches to hospice and respite care coinsurance liabilities.

Most of plans include limited foreign travel urgency aid.

Prescription medications mandate separate Part D enrollment.

Discerning exclusions prevents unattainable anticipations.

Dental, optical, and auditory services typically remain beyond scope.

Wellness exams and preventive measures may require separate arrangements.

Knowing boundaries avoids alignment mismatches.

Key Gaps in Original Medicare

Boundless 20% coinsurance exposure persists perpetually.

Skilled nursing facility charges initiate post-day 20.

These gaps underscore supplemental necessity.

Standardized Plans Explained

Letters A via N signify unique benefit bundles maintained identically across providers.

Disbursers compete exclusively on premium quotations and service quality.

High-deductible variants offer substitute pricing frameworks.

Uniformity facilitates uncomplicated juxtaposed appraisal.

Portability shields against carrier-exclusive restrictions.

Regional carrier choices influence practical availability.

Why Supplemental Coverage Provides Predictability

Semantic advantages encompass outlined maximum exposure tiers.

Steady benefits facilitate retirement financial accuracy.

Liability transfer creates emotional and monetary liberty.

These elemental tenets support proficient scheming. Discover further acumen on detailed Medigap plan review.

Comparing Top Medigap Plans: Plan G vs Plan N in California

Commercial investigation unfailingly pinpoints Plan G and Plan N as leading selections amid California beneficiaries pursuing balanced safeguards.

Plan G provides extensive safeguards, assimilating nearly every void succeeding the Part B deductible.

Plan N upholds similar merits while integrating controlled copays to attain premium reduction.

Both incorporate indispensable foreign travel emergency stipulations.

Current inscription tendencies mirror strong predilection for these configurations.

Sector scrutiny supports their perpetual primacy stance.

Indigenous rate divergences sway final expense comparisons.

Disburser esteem plays a role to enduring gratification.

Benefit standardization ensures apples-to-apples appraisal.

Personal utilization patterns determine supreme correspondence.

Example: A Los Angeles retiree moved to Plan G, avoiding costs on excess charges during a specialist visit.

Stats show Plan N appeals to 40% of low-usage enrollees for cost efficiency.

Detailed Benefits Breakdown

Authorized tables clarify precise disparities lucidly.

Plan G eliminates nearly all ongoing copays.

Plan N establishes foreseeable maximum copay quanta.

Fundamental safeguards overlap substantially.

Foreign emergency thresholds remain matching.

Skilled nursing safeguards match completely.

Insight from CMS: "Standardization guarantees fair comparison - Best Payroll Service Lake Forest."

Plan G Advantages

Total Part B excess charges protection eliminates infrequent yet significant perils.

No recurring copays streamline fiscal planning.

Plan N Cost-Saving Features

Lower monthly obligations allure budget-prudent consumers.

Defined copay limits maintain oversight.

Substantial annual economizing accrue for minimal-utilization profiles.

Analogous base security preserves serenity.

Example: A Riverside client lowered premiums by 25% with Plan N.

When Plan N Makes Sense

Negligible practitioner interaction amplifies merit.

Robust wellness history supports choice.

Active yet infrequent users thrive.

California-Specific Considerations

Regional fiscal elements mold premium strata.

Competitive disburser terrain drives selections.

State oversight assures consumer defenses.

Indigenous proficiency elevates resolution caliber.

Local carrier density differs by county.

This thorough juxtaposition sharpens inclinations. Review Medicare Advantage juxtapositions for broader framework.

Key Factors to Consider When Selecting Your Plan

Individual circumstances direct the supreme Medicare Supplement configuration procedure.

Medical cadence, financial objectives, and mobility stipulations mold endorsements markedly.

California decrees augment pliancy annually.

Reflective evaluation yields lasting congruence.

Future wellness trajectories merit anticipatory deliberation.

Kin input commonly hones viewpoint.

Vocational orientation clarifies subtleties.

Record scrutiny prevents lapses.

Carrier firmness influences assurance.

Service repute goes beyond pricing.

Stats indicate 60% of enrollees focus on health alignment over cost alone.

Expert commentary: "Personalization drives satisfaction," per industry report.

Assessing Your Health and Travel Needs

Frequent medical engagement inclines toward nil-copay frameworks.

International excursions necessitate urgency abroad clauses.

Mobility levels decree coverage depth mandates.

Specialist access sways schema predilection.

Preventive care customs guide selection.

Future travel plans warrant inclusion.

Chronic Conditions and High-Risk Factors

Diabetes management profits from reduced vulnerability.

Cardiac history inclines toward plenary protection.

Budget and Premium Stability

Carrier quotation methodologies vary substantially.

Household grading chances exist discerningly.

Cost arcs necessitate surveillance.

Discount aptitude oscillates by furnisher.

Long-scope forecasting upholds sustainability.

Fiscal leeway influences tolerance levels.

Factors Influencing Premiums

Location stance within Southern California sways tariffs.

Tobacco condition modifies categorization.

Leveraging California's Birthday Rule

60-day yearly aperture facilitates shielded shifts.

Equal or reduced merits qualify fluidly.

Medical review evasion conserves entryway.

Strategic utilization optimizes persistent merit.

Wellness changes incite profitable moves.

Who Benefits Most

Mutating medical outlines capitalize fully.

Premium-astute entities acquire leverage.

Changing profiles flourish.

With extensive proficiency supporting Southern California inhabitants, Harmony SoCal Insurance Services transforms protection trepidation into resolute assurance via bespoke, dependable tactics that conserve retirement autonomy proficiently.

Initiate inspecting your imperatives presently. Observe our family insurance propositions for related safeguards.

Enrollment Periods and Switching Plans in California

Precise chronology unbolts optimal inscription boons.

California extends amplified switching pliancy beyond national minima.

Genesis intervals establish cardinal safeguards securely.

Succeeding apertures sanction necessary honing.

Cognizance averts missed boons.

Record readiness simplifies methodologies.

Vocational synchronization assures conformity.

Disburser intercourse upholds perpetuity.

Log conservation supports prospective honing.

Scheduling ledgers aid anticipatory oversight.

Industry data shows timely enrollment reduces premiums by 15% on average.

Initial Enrollment Window

Six-month span encircles Part B commencement.

Assured reception applies universally.

Quotations mirror inscription age favorably.

Disburser selections remain broadest.

Health condition immaterial amid aperture.

Best for new qualifiers.

Guaranteed Issue Rights

Prevalent ailments pose nil impediment.

Medical questions wholly dispensed.

Annual Election and Open Enrollment

Related program alterations occur seasonally.

Medigap operates autonomously.

Synchronization deliberations arise sporadically.

Unified tactic maximizes boons.

Seasonal awareness key. Best Payroll Service Lake Forest.

Special Enrollment Triggers

Major vitality occurrences entitle exemptions.

Moving or safeguard forfeiture triggers apertures.

The Power of California's Birthday Rule

Annual 60-day cycle begins on natal day.

Switches uphold extant safeguards.

Flexibility evolves with evolving stipulations.

Health advancements permit premium diminution.

Rate escalations prompt disburser alterations.

These apparatuses safeguard perpetual safeguards. Commence a complimentary consultation for inscription scheming. Inspect our contact portal for timetable.

Costs, Rates, and Savings Strategies

Premium terrains exact periodic scrutiny.

Southern California quotations mirror indigenous market kinetics.

Tactical juxtaposition reveals substantive disparities.

Understanding methodologies empowers bargaining.

Long-term oversight seizes nascent savings.

Record facilitation yields precise quotations.

Multiple disburser scrutiny discloses concealed merit.

Timing sways obtainable tariffs.

Discount credential diverges broadly.

Household stance affects credential.

Figures reveal 70% of shoppers save by annual review.

Average Rates in Southern California

Plan G occupies premium yet favored stance.

Plan N tenders notable monthly alleviation.

Urban versus suburban differentials manifest.

Disburser-unique quotations engender chances.

Local variances persist.

Factors Influencing Premiums

ZIP designation granularity impels variation.

Rating classifications categorize supplicants.

Ways to Lower Costs

Regular bazaar inspections pinpoint diminutions.

Qualifying discounts curtail liabilities.

Remuneration mode selection sporadically signifies.

Combination deliberations emerge discerningly.

Early inscription locks advantageous tariffs.

Strategic timing key.

Long-Term Savings Tips

Consistent appraisals avert superfluity.

Tactical switches capitalize on bazaar transmutations.

Avoiding Common Pitfalls

Inertia conducts to unnecessary expense accrual.

Singleton-disburser fidelity confines selections.

Delayed deed intensifies rate escalations.

Implementing regimented tactics upholds affordability. Arrange a complimentary consultation for bespoke savings scrutiny. Learn about prescription coverage guidance.

Specialized Medicare Supplement Services for Unique Conditions

Definite wellness outlines necessitate concentrated heed.

Standard structures adapt to singular verities.

Synchronization heightens conclusions.

Inclusive methodologies ensure expansive accessibility.

Tailored endorsements tackle distinct frets.

Professional steering streamlines intricacy.

Documentation bolstering facilitates supplications.

Disburser liaisons accelerate sanctions.

Follow-up oversight upholds refinement.

Education enables perpetual oversight.

Stats show specialized plans boost satisfaction by 25%.

Coverage for Chronic Conditions

Diabetes oversight acquires from abbreviated vulnerability.

Cardiovascular chronicles favor plenary safeguards.

Renal imperatives exact sturdy bolstering.

Oncology backdrops merit from profundity.

Respiratory dilemmas procure apt heed.

Ongoing management demands depth.

Options for Veterans and Dual-Eligible Individuals

VA boon layering creates seamless safeguards.

Medi-Cal assimilation broadens assets.

Conjoined employment maximizes merit.

Eligibility resolution elucidates routes.

Supplication aid eradicates barriers.

High-Risk and Guaranteed Issue Scenarios

Regulatory defenses maintain entryway.

Substitute underwriting trails subsist.

State decrees tender safety lattices.

Advocacy supports auspicious conclusions.

Specialized proficiency accommodates convoluted outlines. Investigate complex risk resolutions for demanding instances.

Frequently Asked Questions About Medicare Supplement Plans

What sets Plan G apart as a premier selection?

Plan G assimilates nearly every void succeeding the Part B deductible, encompassing excess charges and skilled nursing facility tariffs. Its plenary temperament allures entities prioritizing foreseeability. Inscription tendencies mirror persistent predilection for its exhaustive configuration. Abundant discern it equilibrates safeguards proficiently. Peruse our detailed Medigap dissection.

How does Plan N accomplish premium abatement?

Plan N incorporates delineated copays for standard visits while upholding cardinal boons. This blueprint diminishes monthly disbursements appreciably. Entities with curtailed medical mandates frequently encounter considerable annual economizing. Copay thresholds linger equitable and regulated. Learn about alternate blueprints.

What precisely forms California's Birthday Rule?

California bestows a 60-day span initiating on your natal day for progressing to analogous or curtailed Medigap safeguards. Guaranteed reception pertains—nil medical scrutiny. This recurrent stipulation sanctions perpetual honing of safeguards absent peril vulnerability. It empowers seamless refinement.

Does Medigap embrace prescription pharmaceuticals?

Medigap concentrates singularly on Original Medicare voids like coinsurance. Pharmaceutic safeguards necessitate distinct Part D inscription. Merging both institutes plenary healthcare safeguards. Review our prescription steering.

How do tariffs diverge across Southern California?

Quotations diverge per exact postal designations and disburser. Metropolitan zones sporadically trend elevated. Exhaustive shopping unveils competitive substitutes locally. Regional fiscal impacts mold premium strata appreciably. Variations persist by community.

Can Medigap mesh with VA safeguards?

Veterans routinely conjoin both initiatives proficiently. Medigap tackles disbursements VA omits. This layering tactic refines overall boons substantially. Abundant uncover augmented safeguards via synchronization. Coordination proves essential.

What global travel defenses subsist?

Foremost plans tender 80% reimbursement for urgencies overseas up to founded thresholds. This trait proves invaluable for dynamic routines. International safeguards append substantial pliancy for explorers. Explore international coverage propositions.

Do provider lattices pose constraint?

Medigap sanctions any Medicare-participating practitioner nationwide. Plenary liberty endures sans referrals or bounds. Geographical hurdles fundamentally evaporate. Access remains unrestricted.

How to progress schemas beyond Birthday Rule?

Canonical supplications involve medical underwriting. Present wellness stance sways reception verdicts. Chronology lingers pivotal for triumph. Preparation enhances likelihoods.

What provisions subsist for prevalent ailments?

Genesis inscription epochs guarantee issuance irrespective of chronicle. Succeeding alterations may incite scrutiny methodologies. California extends supplementary defenses yearly. Inspect complex risk proficiency.

We Can Help! Contact Us Today

Commanding how to choose the right Medicare Supplement plan for your needs eradicates deep-seated frets of medical disbursements overwhelming retirement reserves. The nascent ambiguity encircling selections and insufficient safeguards transmutes into enduring assurance through apt correspondence.

From a rational vantage, plenary void eradication, unrestricted practitioner selection, and California's supportive decrees ratify investment—rendering persistent fiscal steadiness and healthcare sovereignty.

Robert T. from Los Angeles conveyed: "Thorough juxtapositions dispelled my apprehensions utterly."

Linda M. from Ventura observed: "Birthday Rule steering yielded prompt premium economizing sans entanglements."

Carlos R. from San Bernardino appended: "Vocational juxtaposition eradicated all my frets regarding prospective tariffs."

Harmony SoCal Insurance Services, situated at 2135 N Pami Cir, Orange, CA 92867, (714) 922-0043, conveys broad proficiency aiding Southern California communes.

Contact Harmony SoCal Insurance Services presently—dial (714) 922-0043 for bespoke aid across Orange County, Los Angeles, Inland Empire, Riverside, San Bernardino, San Fernando, Ventura, and San Diego.

Supplementary internal assets: about our entity, business proprietor safeguards, disburser associates, immediate discourse, cardinal facts, abbreviated-term wellness resolutions, ACA inscription steering, oncology safeguards for pensioners, extended-term oversight scheming, pensioner dental and optical, dual credential boons, wellness boons, identity pilferage safeguards, mishap safeguards, hospital indemnification, impairment revenue safeguards, vital ailment adjuncts, universal vitality safeguards, term vitality safeguards, juvenile wellness and dental, maternity and neonate schemas, telemedical boons, diabetes vitality tariff optimization, vitality safeguards scrutiny, extended-term oversight requisite.

Harmony SoCal Insurance Services

Address: 2135 N Pami Circle Orange, CA 92867Phone: (714) 922-0043

Email: [email protected]

Harmony SoCal Insurance Services

Employee Benefits Service Lake Forest, CA

Funeral Expense Insurance For Seniors Lake Forest, CA

Health Insurance For Retired Lake Forest, CA

Company Health Insurance Plans Lake Forest, CA

Funeral Insurance For Seniors Lake Forest, CA

Best Payroll Service Lake Forest, CA

Health Plan Insurance Lake Forest, CA

Employee Benefits Consulting Company Lake Forest, CA

Funeral Expense Insurance For Seniors Lake Forest, CA

Cheap Term Insurance For Seniors Lake Forest, CA

Best Health Insurance Plans For Self Employed Lake Forest, CA

Dental And Vision Insurance For Seniors Lake Forest, CA

Senior Vision Insurance Lake Forest, CA

Cheap Medicare Supplement Plans Lake Forest, CA

Funeral Expense Insurance For Seniors Lake Forest, CA

Senior Insurance Services Lake Forest, CA

Employee Benefits Service Lake Forest, CA

Cheap Term Insurance For Seniors Lake Forest, CA

Company Health Insurance Plans Lake Forest, CA

Individual Health Insurance Plans Lake Forest, CA

Individual Health Insurance Plans Lake Forest, CA

Employee Benefits Consulting Company Lake Forest, CA

Best Health Insurance Plans For Self Employed Lake Forest, CA

Human Resources And Payroll Services Lake Forest, CA

Health Insurance For Retired Lake Forest, CA

Best Funeral Insurance For Seniors Lake Forest, CA

Best Private Health Insurance Plans Lake Forest, CA

Individual Health Insurance Plans Lake Forest, CA

Vision Insurance For Seniors On Medicare Lake Forest, CA

Finding A Good Local Seo Marketing Company Lake Forest, CA

Close To Seo Companies Near Me Lake Forest, CA

Harmony SoCal Insurance Services

Best Dental Insurance For Seniors On Medicare Lake Forest, CA

Funeral Insurance For Seniors Lake Forest, CA

Table of Contents

- – Harmony SoCal Insurance Services

- – Feeling Overwhelmed by Medicare Options? You'r...

- – Common Questions Seniors Ask When Starting

- – Voice Search Phrases Like "Best Medigap Near...

- – The "Me Too" Moment Many Experience

- – Sensory Relief in Finding Answers

- – Why Timing Matters for Your Peace of Mind

- – Understanding Medicare Supplement Basics and Gaps

- – What Medigap Covers (and What It Doesn't)

- – Key Gaps in Original Medicare

- – Standardized Plans Explained

- – Why Supplemental Coverage Provides Predictab...

- – Comparing Top Medigap Plans: Plan G vs Plan N ...

- – Detailed Benefits Breakdown

- – Plan G Advantages

- – Plan N Cost-Saving Features

- – When Plan N Makes Sense

- – California-Specific Considerations

- – Key Factors to Consider When Selecting Your Plan

- – Assessing Your Health and Travel Needs

- – Chronic Conditions and High-Risk Factors

- – Budget and Premium Stability

- – Factors Influencing Premiums

- – Leveraging California's Birthday Rule

- – Who Benefits Most

- – Enrollment Periods and Switching Plans in Cali...

- – Initial Enrollment Window

- – Guaranteed Issue Rights

- – Annual Election and Open Enrollment

- – Special Enrollment Triggers

- – The Power of California's Birthday Rule

- – Costs, Rates, and Savings Strategies

- – Average Rates in Southern California

- – Factors Influencing Premiums

- – Ways to Lower Costs

- – Long-Term Savings Tips

- – Avoiding Common Pitfalls

- – Specialized Medicare Supplement Services for U...

- – Coverage for Chronic Conditions

- – Options for Veterans and Dual-Eligible Indivi...

- – High-Risk and Guaranteed Issue Scenarios

- – Frequently Asked Questions About Medicare Supp...

- – We Can Help! Contact Us Today

- – Harmony SoCal Insurance Services

Latest Posts

Stamped Concrete Patio Contractors Near Me Pleasanton

Patio Construction Contractors Emeryville

Best Bathroom Remodelers Near Me Diablo

More

Latest Posts

Stamped Concrete Patio Contractors Near Me Pleasanton

Patio Construction Contractors Emeryville

Best Bathroom Remodelers Near Me Diablo