All Categories

Featured

Table of Contents

- – Payroll Service Companies Lake Forest, CA

- – Harmony SoCal Insurance Services

- – Human Resources And Payroll Services Lake Fore...

- – Best Health Insurance Plans For Self Employed ...

- – Senior Citizens Insurance Lake Forest, CA

- – Dental And Vision Insurance For Seniors Lake ...

- – Senior Citizens Insurance Lake Forest, CA

- – Senior Citizens Insurance Lake Forest, CA

- – Senior Insurance Services Lake Forest, CA

- – Health Plan Insurance Lake Forest, CA

- – Insurance Seniors Lake Forest, CA

- – Contractor Payroll Services Lake Forest, CA

- – Harmony SoCal Insurance Services

Payroll Service Companies Lake Forest, CA

Harmony SoCal Insurance Services

2135 N Pami Circle Orange, CA 92867(714) 922-0043

https://maps.google.com/maps?ll=33.823884,-117.830838&z=16&t=h&hl=en&gl=US&mapclient=embed&cid=276141583131225364

Rate of interest will be paid from the date of death to date of repayment. If death is because of all-natural reasons, death profits will certainly be the return of costs, and passion on the premium paid will certainly be at a yearly effective rate defined in the policy contract. This plan does not assure that its profits will be adequate to spend for any kind of specific solution or merchandise at the time of demand or that services or merchandise will be supplied by any type of certain service provider.

A total declaration of protection is found only in the policy. For even more information on protection, prices, restrictions; or to request insurance coverage, speak to a local State Ranch representative. There are limitations and problems concerning payment of advantages due to misrepresentations on the application. Returns are a return of premium and are based upon the actual mortality, expense, and investment experience of the Business.

Human Resources And Payroll Services Lake Forest, CA

Permanent life insurance policy develops money value that can be obtained. Policy loans accrue passion and unsettled plan fundings and interest will certainly minimize the fatality benefit and money value of the plan. The quantity of cash money worth offered will normally rely on the sort of long-term policy purchased, the quantity of coverage bought, the length of time the policy has been in pressure and any superior plan fundings.

They are generally issued to candidates with several health and wellness problems or if the candidate is taking specific prescriptions. If the insured passes during this duration, the recipient will usually get all of the premiums paid into the policy plus a small additional percent. An additional final cost option offered by some life insurance policy business are 10-year or 20-year strategies that give applicants the option of paying their policy in complete within a particular timespan.

The most essential thing you can do is answer inquiries honestly when obtaining end-of-life insurance. Anything you withhold or hide can create your benefit to be rejected when your family members needs it most. Some individuals believe that due to the fact that most last expenditure plans do not require a clinical test they can exist about their health and the insurer will certainly never ever recognize.

Share your last dreams with them as well (what flowers you might want, what passages you desire read, tunes you desire played, etc). Documenting these in advance of time will conserve your enjoyed ones a great deal of stress and anxiety and will stop them from attempting to presume what you desired. Funeral prices are increasing all the time and your health can transform suddenly as you obtain older.

Best Health Insurance Plans For Self Employed Lake Forest, CA

The key beneficiary gets 100% of the fatality benefit when the insured dies. If the main recipient passes before the guaranteed, the contingent gets the advantage.

It is necessary to regularly review your beneficiary info to see to it it's current. Constantly notify your life insurance policy firm of any change of address or contact number so they can update their records. Numerous states allow you to pre-pay for your funeral service. Prior to you pre-pay, examine to see exactly how the cash will be held.

The death benefit is paid to the main recipient once the claim is approved. It depends on the insurance coverage business.

Senior Citizens Insurance Lake Forest, CA

If you do any kind of sort of funeral planning ahead of time, you can record your last want your main recipient and show just how much of the policy advantage you wish to go towards final setups. The process is usually the very same at every age. The majority of insurer require a private be at least 1 month of age to look for life insurance coverage.

Some firms can take weeks or months to pay the plan benefit. Others, like Lincoln Heritage, pay accepted claims in 24 hours. Best Health Insurance Plans For Self Employed Lake Forest. It's tough to claim what the ordinary costs will certainly be. Your insurance rate relies on your health and wellness, age, sex, and how much protection you're getting. A great quote is anywhere from $40-$60 a month for a $5,000 $10,000 policy.

Cigarette rates are greater regardless of what sort of life insurance policy you obtain. The older you are, the greater your cigarette rate will certainly be. Last expenditure insurance coverage lifts a monetary concern from families regreting the loss of a person they enjoy. If you intend to supply those you care regarding a safety web throughout their time of pain, this policy kind is a fantastic option.

Dental And Vision Insurance For Seniors Lake Forest, CA

Our content is based entirely on objective study and data event. We preserve stringent content self-reliance to guarantee objective coverage of the insurance industry. No person likes to believe about their funeral service or memorial solution, however planning in advance is a wise choice that secures your household's financial health when they are grieving a loss.

The survivor benefit from final cost insurance can be used to spend for end-of-life expenses, such as last medical costs or funeral costs. Interment insurance is best for senior citizens or individuals with major wellness conditions that restrict them from getting typical life insurance policy protection. Traditional term life insurance is extra inexpensive and supplies greater insurance coverage quantities than final cost insurance.

Senior Citizens Insurance Lake Forest, CA

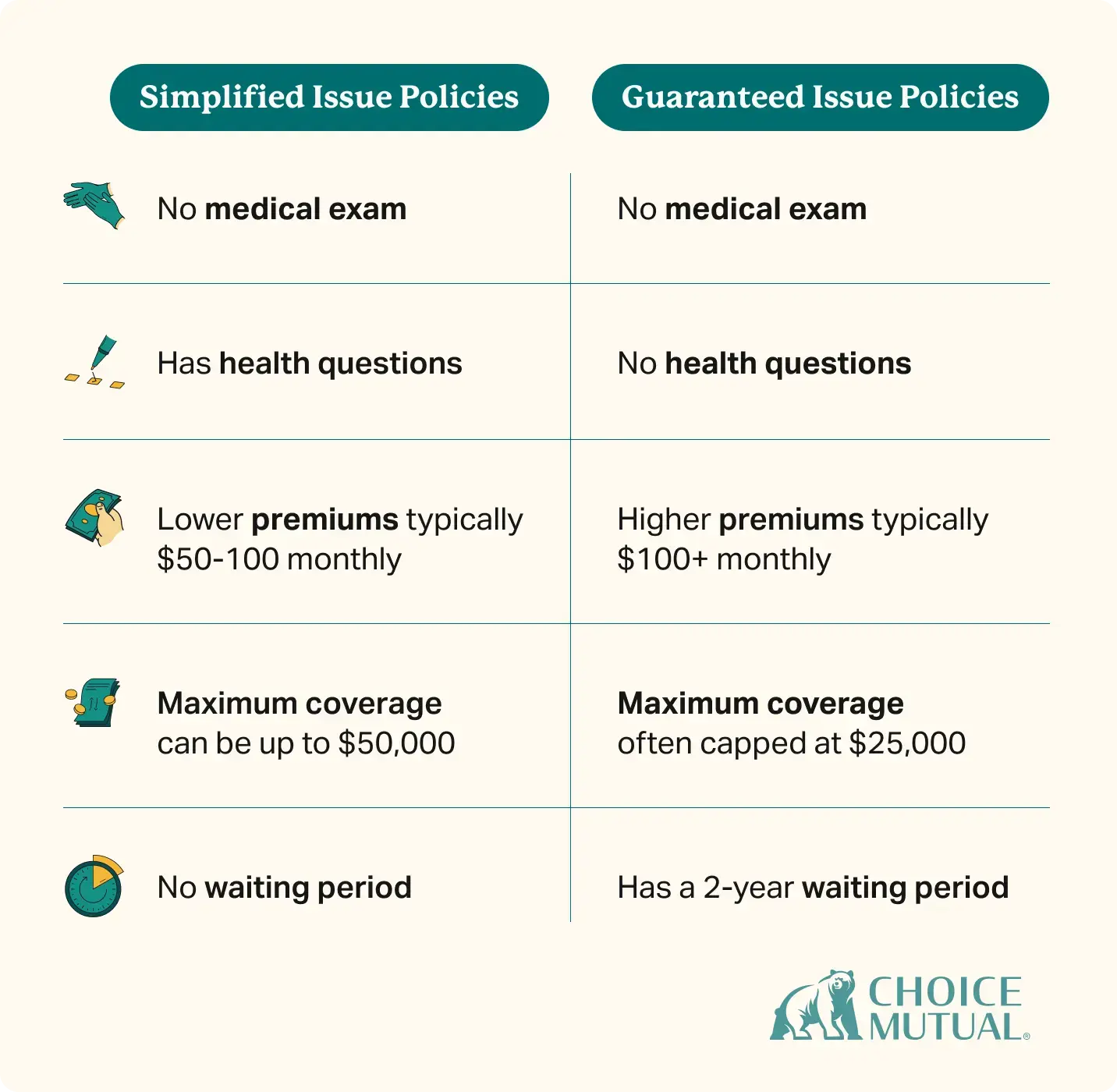

Unlike conventional life insurance coverage plans, last expense insurance coverage generally does not call for a medical examination, which makes it easily accessible to people that may have pre-existing health and wellness conditions. Rather, applicants usually answer a few health-related inquiries throughout the application process. The premiums stay level throughout the life of the plan, meaning they will not boost as you age, providing assurance for seniors on a set income.

While several life insurance companies offer these policies, in certain states, funeral homes may likewise market them. Funeral expenses vary commonly, but the ordinary funeral price can cost thousands.

Like all types of life insurance policy, final cost insurance coverage costs have a tendency to rise with age. The older you are when you get a plan, the extra you'll have to pay over the lifetime of the plan. The chart below displays typical yearly premiums for men and women age 45 to 65.

Senior Citizens Insurance Lake Forest, CA

You can pre-pay for your funeral through a funeral home, however if the funeral home goes out of service in the future, you'll shed that money. You can put cash into a trust that your beneficiaries would make use of for your end-of-life expenditures.

Completely underwritten life insurance policy can provide extra for much less. A waiting duration (commonly 2 years) prior to the full survivor benefit is paid. If fatality occurs early, partial or no benefits are paid. These policies use a knockout concern system: Identified with help? Bedridden or constrained to an assisted living facility or healthcare facility? Require support with everyday living tasks? Alzheimer's, Lou Gehrig's, mental deterioration? Terminal or metastatic cancer cells? Do you have coronary infarction? Diabetes mellitus? Kind 1 or Type 2COPD or emphysema? Cancer Breast, prostate, colon, lung, leukemia? Kidney disease Elevated lab results, transplants? Heart Conditions cardiovascular disease, bypass surgical treatment? Mental wellness problems bipolar or anxiety? Parkinson's disease or numerous sclerosis? Stroke or TIA? Male, age 65 $25,000 rated advantage last expenditure plan.

Senior Insurance Services Lake Forest, CA

And if you've been told that your wellness condition would only permit a rated plan, don't believe it! The above rates are available for individuals with health problems like heart problem, a background of cancer cells, diabetes, liver disease, and HIV+. No health and wellness questions, no medical exam, and everyone obtains approved but with a 2-year waiting duration.

The survivor benefit will certainly differ based upon a few variables. First, of training course, is the quantity of insurance coverage you determine ona $10,000 plan will certainly set you back less than a $30,000 policy, and so on. It is likewise established by your health, the insurance provider, and what they use, as well as your age.

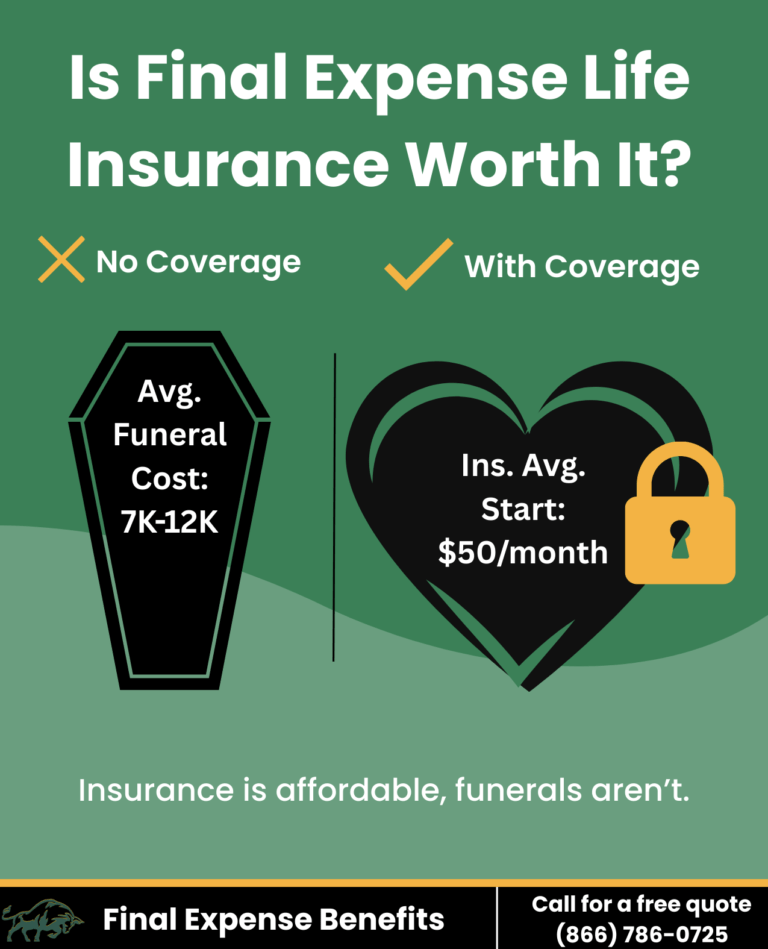

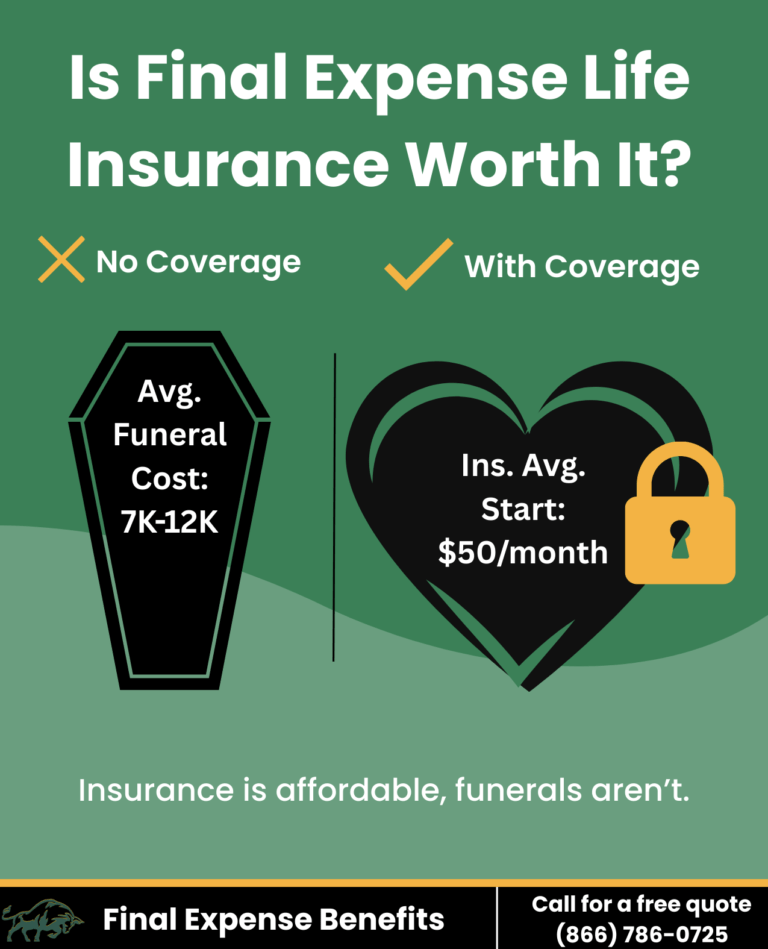

The typical funeral with burial costs about $8,000. Without something to cover these costs, your enjoyed ones may have a really difficult time paying for the essential costs. With final expenditure, you relieve this burden.

Health Plan Insurance Lake Forest, CA

Understanding that life insurance aids cover costs should not be also unusual. Possibly you waited also long, and now are too old to be eligible for a policy.

There are two types of last expense policiessimplified concern and guaranteed issue. With streamlined problem, all you need to do is answer an easy questionnaire concerning your wellness. You will qualify as long as long as you have no lethal problems. With ensured issue, you'll have guaranteed authorization. Most importantly, you can live easily knowing that you have the insurance coverage you and your liked ones need (Best Health Insurance Plans For Self Employed Lake Forest).

Insurance Seniors Lake Forest, CA

Secure Insurance coverage Group wishes to make your coverage as easy as possible. Call us today or email for additional information.

Final expense insurance policy is a kind of life insurance that helps elders If you don't have a final cost life insurance strategy in area for these bills, your liked ones will certainly be in charge of them by default. Funeral expenses are expensive, and there are probably more expenses than you knew.

Be warned, however, that a lot of firms enable you buy a plan with a really little benefit. $3,000 is the minimal advantage amount with one of the carriers we represent. Be cautious that you do not underestimate your last cost costs. A $3,000 plan is not virtually enough to cover one of the most fundamental of funerals.

At The Paul Group, we'll function with you one-on-one to establish exactly how much protection you require. Several of our clients likewise consist of a padding for clinical expenses, unpaid bills, or tradition presents for enjoyed ones.

Contractor Payroll Services Lake Forest, CA

A lot of our clients get accepted the same day they apply. If you've been denied forever insurance policy in the past, this might be the service you've been seeking. No person suches as considering the end of lifebut preparation ahead is just one of one of the most thoughtful presents you can offer your household.

As you age, your requirements for life insurance adjustment.

Seniors might be thinking of end-of-life arrangements so they do not transfer that worry to their liked ones they leave behind. Usually, by this time in your life, your children are grown and you're preparing to appreciate retired life (Best Health Insurance Plans For Self Employed Lake Forest). Despite how old you are, it's never ever far too late to consider life insurance policy

Harmony SoCal Insurance Services

Address: 2135 N Pami Circle Orange, CA 92867Phone: (714) 922-0043

Email: [email protected]

Harmony SoCal Insurance Services

If you are still functioning, you might wish to choose in to a group strategy, and if you're not, make certain you get a selection of quotes and compare prices. One business may see you as more of a risk compared to an additional. Budget-friendly life insurance coverage for seniors is possible with a little research study.

Payroll Service Companies Lake Forest, CABest Dental Insurance For Seniors On Medicare Lake Forest, CA

Senior Solutions Insurance Lake Forest, CA

Near My Location Seo Companies Near Me Lake Forest, CA

Find A Good Local Seo Company Near Me Lake Forest, CA

Best Health Insurance Plans For Self Employed Lake Forest, CA

Harmony SoCal Insurance Services

Table of Contents

- – Payroll Service Companies Lake Forest, CA

- – Harmony SoCal Insurance Services

- – Human Resources And Payroll Services Lake Fore...

- – Best Health Insurance Plans For Self Employed ...

- – Senior Citizens Insurance Lake Forest, CA

- – Dental And Vision Insurance For Seniors Lake ...

- – Senior Citizens Insurance Lake Forest, CA

- – Senior Citizens Insurance Lake Forest, CA

- – Senior Insurance Services Lake Forest, CA

- – Health Plan Insurance Lake Forest, CA

- – Insurance Seniors Lake Forest, CA

- – Contractor Payroll Services Lake Forest, CA

- – Harmony SoCal Insurance Services

Latest Posts

Stamped Concrete Patio Contractors Near Me Pleasanton

Patio Construction Contractors Emeryville

Best Bathroom Remodelers Near Me Diablo

More

Latest Posts

Stamped Concrete Patio Contractors Near Me Pleasanton

Patio Construction Contractors Emeryville

Best Bathroom Remodelers Near Me Diablo