All Categories

Featured

Table of Contents

- – Senior Insurance Advisor Anaheim, CA

- – Harmony SoCal Insurance Services

- – Best Senior Health Insurance Anaheim, CA

- – Senior Insurance Quotes Anaheim, CA

- – Medical Insurance For Senior Anaheim, CA

- – Senior Insurance Advisor Anaheim, CA

- – Health Insurance Seniors Anaheim, CA

- – Best Eye Insurance For Seniors Anaheim, CA

- – Harmony SoCal Insurance Services

Senior Insurance Advisor Anaheim, CA

Harmony SoCal Insurance Services

2135 N Pami Circle Orange, CA 92867(714) 922-0043

https://maps.google.com/maps?ll=33.823884,-117.830838&z=16&t=h&hl=en&gl=US&mapclient=embed&cid=276141583131225364

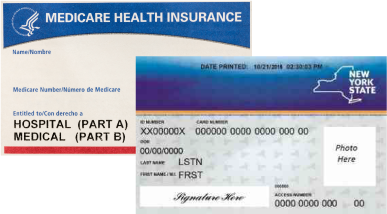

It is necessary to review your alternatives at this time to see to it you remain to have the Medicare health and medication insurance coverage you want. Some sorts of Medicare wellness plans aren't Medicare Benefit Plans, yet are still part of Medicare. The insurance coverage they use varies relying on the certain type of plan.

Medicaid additionally covers added solutions beyond those provided under Medicare, consisting of nursing facility care past the 100-day limit or skilled nursing center care that Medicare covers, prescription drugs, eyeglasses, and listening devices. Providers covered by both programs are very first paid by Medicare with Medicaid completing the difference as much as the state's settlement limit.

* Functions available vary by plan. *Please keep in mind, MVP is needed by legislation to send out some strategy papers by postal mail. +MVP virtual treatment services through Gia are available at no cost-share for many participants. In-person sees and referrals go through cost-share per strategy. Exceptions exist for self-funded strategies. Gia telemedicine services will certainly be $0 after the deductible is met on MVP QHDHPs starting January 1, 2025, upon strategy revival unless the Affordable Treatment Act 2023 QHDHP/HSA risk-free harbor is even more expanded.

Wellness benefit strategies are provided by MVP Health insurance, Inc., an operating subsidiary of MVP Health and wellness Treatment, Inc. Not all strategies readily available in all states and counties. Every year, Medicare examines plans based on a 5-star score system. Out-of-network/non-contracted service providers are under no commitment to treat MVP Wellness Strategy members, other than in emergency situation circumstances.

Best Senior Health Insurance Anaheim, CA

Listen to this page. Anaheim Senior Insurance Plans. Your browser does not sustain the sound component. If you are a PSERS retired person, survivor annuitant, or the spouse or dependent child of a PSERS retiree or survivor annuitant, and you are qualified for Medicare, you can sign up in: Medicare Supplement plan: jump Medical Strategy Value Medical Strategy Medicare Benefit plan (Highmark, Aetna, Independent Blue Cross, Capital Blue Cross, or UPMC) If you keep Initial Medicare, you can supplement it by enrolling in a Medicare Supplement strategy

Coverage while taking a trip abroad is limited to solutions covered by Medicare. Pay an annual deductible ($257 in 2025) prior to the Plan begins cooperating the cost of covered services. Note: If you tire your Medicare advantages, this plan does not supply added insurance coverage. Pay a $300-per-admission copay if you are confessed to the medical facility.

You can select a Medicare Advantage plan instead of Initial Medicare and a Medicare Supplement plan. If you pick this option, you can not enlist in any type of other Medicare prescription medication strategy.

Each plan offers just particular locations, so the strategies available to you depend upon where you live. You have to utilize an in-network provider to obtain the maximum advantage. See the regional Medicare Benefit plan overviews for descriptions of the Medicare Benefit intends offered where you live, the advantages they offer, and their prices.

Senior Insurance Quotes Anaheim, CA

There is no one-size-fits-all choice when it comes to choosing the finest Medicare strategy, as people have various scenarios, needs, and top priorities. Other factors to consider play a role, the decision might come.

down to weighing the evaluating benefits of Original Medicare against the versus benefits monetary Medicare Advantage plansBenefit For numerous seniors, a wonderful choice is Original Medicare (Components A and B)with Medicare Supplement Plan G from AARP/UnitedHealthcare (UHC)if you don't mind paying even more per month for more versatility when it comes to selecting your medical professional.

Medical Insurance For Senior Anaheim, CA

Best for bundled protection: Medicare AdvantageBest for bundled insurance coverage: Medicare Benefit Ideal if you have a reduced revenue: MedicaidBest if you have a reduced earnings: Medicaid Medicare is the very best medical insurance option for senior citizens and senior citizens. Medicare is the least expensive health and wellness insurance policy with the most effective advantages for people. Original Medicare includes Part A(medical facility insurance coverage) and Part B( medical insurance ). With Initial Medicare, you can get care from 99%of the physicians in the country. On top of Original Medicare, you can add extra insurance coverage from exclusive medical insurance business via a Medicare Supplement strategy( additionally called Medigap ). Another add-on is a Medicare Part D prepare for prescription drug protection, which is your only means to get prescription drug insurance policy with Original Medicare.(also called Medicare Component C)is a wellness insurance strategy that you buy from a private insurance coverage firm. Strategies need to cover the same solutions as Initial Medicare, and they typically include prescription medicines, oral and vision. AARP/UnitedHealthcare has the very best Medicare Benefit plans for 2025 as a result of its affordable price, good protection and high degrees of customer satisfaction. AARP/UnitedHealthcare has the most effective combination of price, protection and quality. The business additionally markets strategies nationwide, other than in Alaska. This overall solid performance makes it the finest Medicare Advantage company. This suggests you're only liable for paying$ 185 monthly for Medicare Component B. AARP/UnitedHealthcare's Medicare Benefit strategies have great scores on, with approximately 3.6 out of 5 stars. That puts it among the most effective companies that offer strategies nationwide. AARP/UnitedHealthcare markets Medicare Benefit prepares in every state yet Alaska. AARP/UnitedHealthcare is the best firm for Medigap strategies in 2025. For most individuals, the very best business for Medigap coverage is AARP/UnitedHealthcare. Anaheim Senior Insurance Plans. Medicare Supplement(Medigap)prepares cover a number of the costs that you normally pay if you have routine Medicare. The coverage you obtain

with a provided plan letter coincides no matter of which company you pick. Medigap prepares usually cost greater than Medicare Benefit. Nevertheless, you'll generally pay less when you get clinical treatment with a Medigap plan than with a Medicare Advantage plan. This is especially valuable for seniors that are worried regarding clinical expenses rising as they age. With Medigap, you can most likely to any kind of doctor that approves Medicare. Plan G does not cover the yearly Medicare Component B insurance deductible, which is just$257. This means you'll need to pay for some treatment at the start of the policy year before your spending reaches that quantity. In enhancement to the standardized insurance coverage for clinical and medical facility care, AARP/UnitedHealthcare strategies stand apart for the wide option of added add-on coverage. Yet, there are some exceptions to this rule. AARP/UnitedHealthcare provides Medigap Select Plan G, which only has protection for in-network doctors. Choosing this option can provide you the exact same coverage as a typical Strategy G yet at a more affordable rate. UnitedHealthcare gets roughly 40 %less complaints than an average business its size. Wellcare is the ideal Medicare Component D firm due to the fact that it provides high-grade, budget friendly protection. The business has low ordinary monthly prices, and some strategies set you back as low as $0 monthly. If you pick Initial Medicare, the only method to have protection for prescription drugs is to register for a stand-alone prescription drug strategy called Medicare Part D. Also the cheap plans usually provide an excellent worth for the protection you get. All strategies have$0 copays for generic medicines. Wellcare will certainly likewise ship your medicines to your home at no additional cost to you. Wellcare Component D strategies have a high average score on Plus, Wellcare has the most popular stand-alone Part D strategy in the country. Blue Cross Blue Shield has an average of 3.5 out of 5 stars

Senior Insurance Advisor Anaheim, CA

on, while UnitedHealthcare and Aetna both have 3 celebrities. BCBS is one of the largest medical insurance companies in the country and has one of the largest networks of doctors and hospitals. Several Blue Cross Blue Shield business have advantages that go past what a conventional health insurance plan uses. This indicates you can individualize your insurance coverage to your one-of-a-kind requirements. Also though some strategies only cover in-network clinical care, UHC's large network of medical professionals gives you much more liberty about where you obtain wellness treatment while still staying in the network. Medicaid is the most budget friendly plan for senior citizens and senior citizens that have low earnings. Even if you currently have Medicare, you can dual enroll in both Medicaid and Medicare to reduce your medical prices. Income limitations for Medicaid depend on where you live. In 40 states and Washington, D.C., you can get approved for Medicaid if you make. The limitations are higher in Alaska and Hawaii. Elders aged 65 and over who gain excessive to certify for Medicaid may still be able to certify if they have high clinical expenses. The Medicaid spend down program allows you deduct your clinical expenses from your earnings. You can utilize this minimized total up toreceive Medicaid. Medicare is the very best health and wellness insurance for retirees and senior citizens. Factors such as expense, protection, advantages and networks of medical professionals were used to contrast companies. Other sources consist of: Medicare Benefit prices are only for strategies that include prescription medicine advantages. The rate analysis omits employer-sponsored strategies, Special Needs Strategies, speed plans, approved strategies and Healthcare Prepayment Program( HCPPs). Medigap costs are based on information for all personal business, making use of quotes for a 65-year-old women nonsmoker. By calling an Expert at you can obtain a totally free contrast of your company strategy with your Medicare choices.

Residents in Pennsylvania have the option to sign up right into a Medicare Supplement Strategy( Medigap), Prescription Drug Plan (Part D or PDP )or a Medicare Advantage Strategy( Part C). Medicare Supplements are non-network-based strategies, indicating you can see any type of medical professional or specialist that accepts Medicare. As mentioned, they can be acquired to accompany your Medicare Supplement Strategy or bought alone to match your Initial Medicare Parts A and B. Prescription Drug Program are not suggested to cover 100 %of your prescription expense, yet to assist lower your prices.

Health Insurance Seniors Anaheim, CA

You still have Medicare Component A and B, these benefits are currently handled by your chosen carrier. Nonetheless, this is not constantly real so be certain you know the advantages of the strategy in which you select to enroll. Medicare: Pennsylvania Division of Person Providers: Pennsylvania Division of Aging:. To certify, you have to have spent at the very least 3 successive days as a medical facility inpatient within one month of admission to the SNF, and require experienced nursing or treatment services.Home healthcare: Medicare covers services in your home if you are homebound and need knowledgeable treatment. You are covered for as much as 100 days of daily treatment or an endless amount of periodic care. You are covered for as long as your carrier accredits you require treatment. Medicare does not usually pay the complete price of your care, and you will likely be accountable for some part of the cost-sharing(deductibles, coinsurances, copayments)for Medicare-covered solutions. The majority of individuals do not pay a monthly Component A premium since they or a spouse have 40 or more quarters of Medicare-covered work. If a person has 30 to 39 quarters of Medicare-covered employment, the Component A costs is $285(in 2024,$ 278) per month. Carrier services: Clinically required services you get from a certified wellness specialist. Sturdy clinical devices(DME):This is devices that serves a clinical objective, has the ability to stand up to repeated usage, and is appropriate for use in the home. Treatment services: These are outpatient physical, speech, and work therapy services given by a Medicare-certified therapist. Mental health services. X-rays and lab tests. Chiropractic treatment when manipulation of the spinal column is clinically necessary to fix a subluxation of the back(when one or.

more of the bones of the back step out of setting). Select prescription medications, consisting of immunosuppressant medications, some anti-cancer drugs, some anti-emetic drugs, some dialysis medicines, and drugs that are typically provided by a medical professional. Medicare does not normally pay the complete cost of your care, and you will likely be accountable for some portion of the cost-sharing( deductibles, coinsurances, copayments)for Medicare-covered.

Best Eye Insurance For Seniors Anaheim, CA

services. The 2025 Part-B costs is$185( in 2024,$174.70)each month(premiums will be greater for people with annual incomes of$106,000(in 2024,$103,000)or more and couples with yearly earnings of$ 212,00(in 2024,$206,000)or more. )Please see 2025 Medicare Component A & B Premiums, Deductibles, and Coinsurances 2024 Medicare Part A & B Premiums, Deductibles, and Co-Insurances) web page for info pertaining to the Medicare Part A and Part B deductibles and coinsurances. Medicare Supplement Plans are health and wellness insurance policy plans that use standardized advantages to deal with Initial Medicare( not with Medicare Benefit). They are marketed by personal insurance provider. If you have a supplement plan, it pays component or all of certain continuing to be expenses after Initial Medicare pays. These strategies may cover impressive deductibles, coinsurance, and copayments and might likewise cover health treatment expenses that Medicare does not cover at all, like treatment obtained when taking a trip abroad. When you become qualified for Medicare, you may require to enlist in both Medicare Part A(Healthcare Facility Insurance Policy)and Part B(Medical Insurance policy)to get complete take advantage of your retired person coverage. You have a limited time to register for Medicare without paying a penalty. Senior citizen coverage might not pay your medical prices throughout any kind of time period when you were eligible for Medicare however really did not register for it. In various other cases, your employer or union might offer retired person coverage for you and/or your partner that restrictions just how much itwill pay. For instance , it could only start paying your out-of-pocket expenses when they reach an optimum quantity. For details on your retired person protection, talk to your benefits administrator.

If you select not to sign up with a Medicare drug strategy, you'll require to have worthy medication coverage to prevent paying a Part D late enrollment penalty. Because Medicare pays initially after you retire, your retired person protection is most likely comparable to coverage from a Medicare Supplement Insurance Policy(Medigap)policy. You have to have Part A and Component B to elect a Medicare Advantage strategy accessed with FEHB.

Harmony SoCal Insurance Services

Address: 2135 N Pami Circle Orange, CA 92867Phone: (714) 922-0043

Email: [email protected]

Harmony SoCal Insurance Services

You need to have Component A and Part B to pick a Medicare Benefit strategy. A lot of Medicare Benefit plans deal medicine insurance coverage. Find plans and register by utilizing the Medicare Strategy Finder.

Anaheim, CAAnaheim, CA

Anaheim, CA

Find A Good Local Seo Services For Small Business Anaheim, CA

Near My Location Seo Consultant Anaheim, CA

Senior Insurance Plans Anaheim, CA

Harmony SoCal Insurance Services

Table of Contents

- – Senior Insurance Advisor Anaheim, CA

- – Harmony SoCal Insurance Services

- – Best Senior Health Insurance Anaheim, CA

- – Senior Insurance Quotes Anaheim, CA

- – Medical Insurance For Senior Anaheim, CA

- – Senior Insurance Advisor Anaheim, CA

- – Health Insurance Seniors Anaheim, CA

- – Best Eye Insurance For Seniors Anaheim, CA

- – Harmony SoCal Insurance Services

Latest Posts

Tankless Water Heater Installation Del Mar Heights

Tankless Hot Water Heater Installers Near Me Rancho Penasquitos

Plumber Near Me Clogged Toilet Tierrasanta San Diego

More

Latest Posts

Tankless Water Heater Installation Del Mar Heights

Tankless Hot Water Heater Installers Near Me Rancho Penasquitos

Plumber Near Me Clogged Toilet Tierrasanta San Diego