All Categories

Featured

Table of Contents

- – Employee Benefits Consultants Seal Beach, CA

- – Harmony SoCal Insurance Services

- – Top Employee Benefits Brokers Seal Beach, CA

- – Employee Benefits Broker Near Me Seal Beach, CA

- – Employee Benefits Brokerage Firms Seal Beach, CA

- – Employee Benefits Outsourcing Companies Seal ...

- – Key Man Disability Insurance Seal Beach, CA

- – Employee Benefits Solutions Seal Beach, CA

- – Employee Benefits Brokerage Firms Seal Beach...

- – Employee Benefits Management Solutions Seal ...

- – Harmony SoCal Insurance Services

Employee Benefits Consultants Seal Beach, CA

Harmony SoCal Insurance Services

2135 N Pami Circle Orange, CA 92867(714) 922-0043

Harmony SoCal Insurance Services

It's incredibly simple to start with an online payroll solution and include on services such as time and attendance, HR, insurance coverage, retirement and more as you require them. ADP mobile solutions offer workers accessibility to their payroll info and benefits, no matter where they are. Staff members can finish a range of tasks, such as sight their pay stubs, manage their time and participation, and enter time-off demands.

That's why many employers turn to payroll solution companies for automated remedies and conformity proficiency. A pay-roll service might still be of assistance.

Handling payroll in several states requires monitoring, understanding and conforming with the tax regulations and laws in all states where you have workers. If you're doing payroll manually currently and plan to switch over to a pay-roll service company, you ought to expect to lower the time you dedicate to the procedure.

We likewise provide to numerous sectors, including building and construction, manufacturing, retail, healthcare and more. ADP's payroll solutions are automated, making it simple for you to run payroll. Right here are some of the essential steps to the procedure that we'll manage for you behind the scenes: The complete hours worked by staff members is multiplied by their pay prices.

Top Employee Benefits Brokers Seal Beach, CA

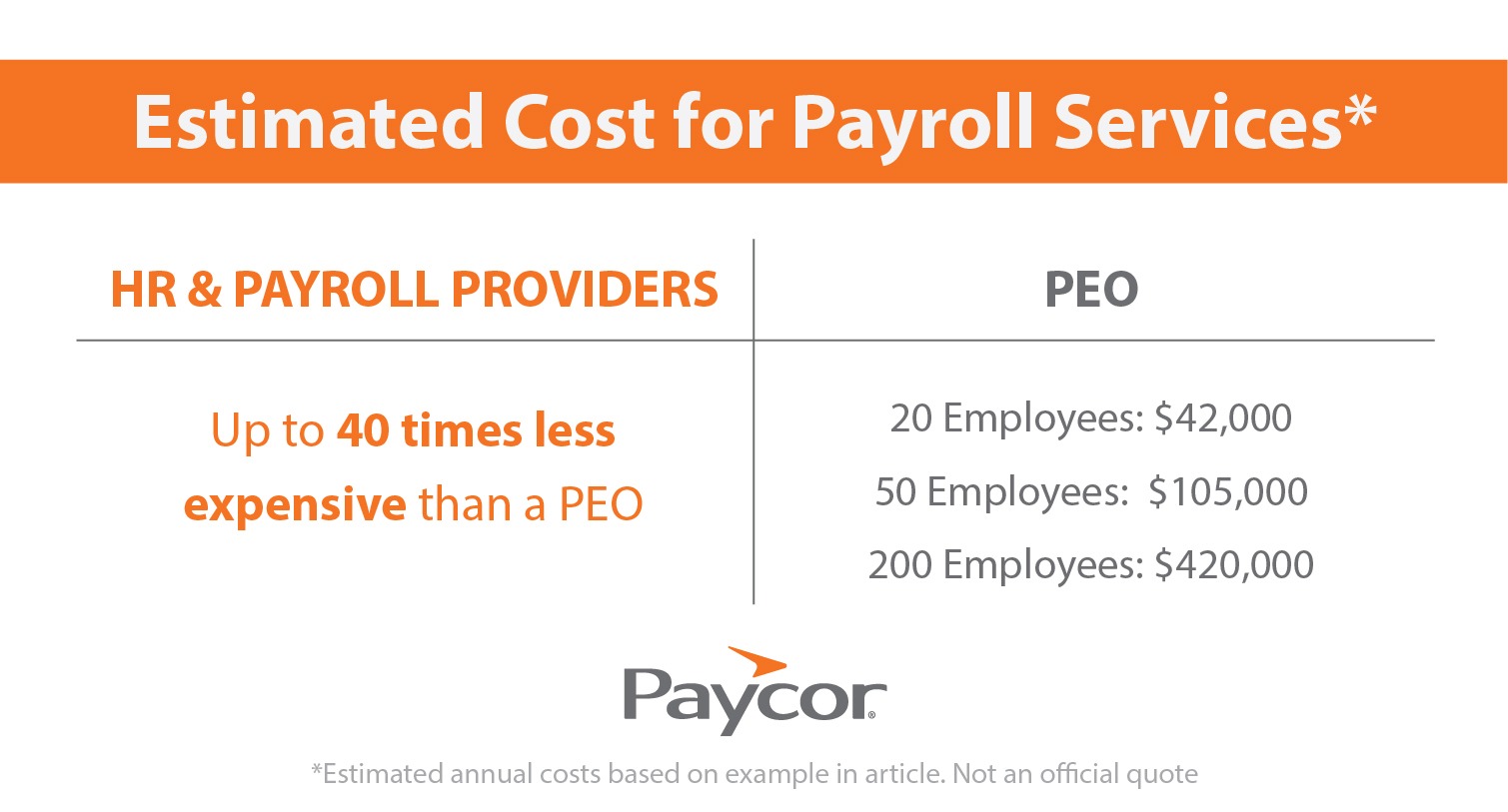

Swing pay-roll with tax declaring sets you back $40 plus $6 per energetic employee or independent professional monthly. This version costs $20 plus $6 per active employee or independent service provider monthly.

It immediately calculates, documents, and pays payroll tax obligations. Employers can carry out pay-roll tasks with voice assistant combinations with Siri and Google or receive text alerts.

Full-service pay-roll companies file taxes on your part. Pay-roll prices may bundle tax obligation declaring, year-end kinds, and worker payments right into the base charge.

A Qualified Customer must be refining pay-roll with Paychex in order to obtain 6 months of cost-free pay-roll solutions, and any type of extra month is not redeemable in U.S. money or for any type of various other entity. The Promotion only applies to payroll services, and Qualified Clients will be exclusively in charge of all charges due for solutions apart from pay-roll solutions.

Employee Benefits Broker Near Me Seal Beach, CA

We provide direct down payment and mobile pay-roll remedies that integrate with time and presence tracking. We likewise immediately determine reductions for tax obligations and retirement payments, and provide professional assistance to assist make certain you remain certified with all applicable rules and guidelines. ADP helps firms manage pay-roll taxes by automating reductions from worker earnings and making certain the ideal amount of money is supplied to the federal government, based on the latest payroll tax obligation policies and laws.

As a matter of fact, it's exceptionally very easy to start with an online pay-roll solution and add services such as time and presence, HR, insurance policy, retirement and more as you require them. ADP mobile remedies offer employees access to their pay-roll info and advantages, regardless of where they are. Staff members can complete a variety of jobs, such as sight their pay stubs, manage their time and presence, and go into time-off demands.

That's why numerous companies turn to pay-roll solution companies for automated solutions and conformity experience. A payroll service might still be of assistance.

Employee Benefits Brokerage Firms Seal Beach, CA

Processing payroll in numerous states calls for tracking, understanding and abiding by the tax laws and policies in all states where you have staff members. You may additionally require to register your organization in those states also if you don't have a physical area. Discover more about multi-state compliance If you're doing pay-roll manually now and plan to switch to a payroll provider, you ought to expect to decrease the time you devote to the procedure.

ADP provides payroll solutions for organizations of all dimensions small, midsized and huge. We likewise satisfy many industries, including building, manufacturing, retail, healthcare and even more. ADP's pay-roll services are automated, making it simple for you to run payroll. Below are some of the essential steps to the process that we'll deal with for you behind the scenes: The overall hours worked by staff members is increased by their pay rates.

Full-service pay-roll firms submit taxes on your behalf. Some payroll suppliers use personnel details systems with benefits administration, hiring, and efficiency monitoring devices. If you just hire freelancers and professionals, think about an inexpensive pay-roll solution for 1099 workers. Payroll prices may pack tax obligation declaring, year-end types, and worker settlements into the base cost.

A Qualified Client has to be processing payroll with Paychex in order to get 6 months of cost-free pay-roll services, and any type of extra month is not redeemable in U.S. money or for any type of various other entity. The Promo just relates to payroll solutions, and Qualified Clients will certainly be exclusively in charge of all fees due for services aside from pay-roll services.

Employee Benefits Outsourcing Companies Seal Beach, CA

We supply direct down payment and mobile payroll solutions that incorporate with time and attendance monitoring. We also instantly calculate reductions for tax obligations and retired life payments, and supply skilled assistance to aid ensure you stay certified with all suitable guidelines and laws. ADP helps companies handle payroll tax obligations by automating deductions from worker salaries and seeing to it the appropriate quantity of money is delivered to the government, based upon the most up to date payroll tax obligation regulations and guidelines.

ADP mobile solutions offer employees accessibility to their pay-roll info and benefits, no issue where they are. Staff members can complete a range of tasks, such as sight their pay stubs, manage their time and presence, and go into time-off demands.

This procedure can be time consuming and mistake prone without the appropriate sources. That's why several companies turn to payroll company for automated remedies and compliance expertise. Companies normally aren't required to withhold taxes from settlements to independent service providers, which simplifies payroll processing. A payroll service may still be of help.

Handling payroll in several states needs monitoring, understanding and complying with the tax obligation legislations and laws in all states where you have staff members. If you're doing pay-roll manually currently and plan to switch to a pay-roll solution provider, you should anticipate to reduce the time you devote to the process.

Key Man Disability Insurance Seal Beach, CA

We likewise provide to many industries, including construction, manufacturing, retail, healthcare and even more. ADP's pay-roll services are automated, making it very easy for you to run payroll. Right here are some of the vital steps to the procedure that we'll handle for you behind the scenes: The overall hours worked by employees is increased by their pay rates.

Full-service payroll business file tax obligations in your place. Some payroll companies offer human resource details systems with advantages management, employing, and efficiency management devices. If you just work with consultants and service providers, think about an affordable pay-roll service for 1099 workers. Pay-roll prices may bundle tax declaring, year-end forms, and worker settlements right into the base cost.

A Qualified Customer has to be refining pay-roll with Paychex in order to get 6 months of cost-free payroll services, and any type of unused month is not redeemable in U.S. currency or for any type of various other entity. The Promotion just applies to payroll services, and Eligible Customers will certainly be solely in charge of all costs due for services apart from payroll solutions.

We supply direct deposit and mobile payroll solutions that integrate with time and presence monitoring. We also instantly determine deductions for taxes and retirement contributions, and supply skilled assistance to assist make certain you remain compliant with all relevant policies and guidelines. ADP helps companies manage payroll taxes by automating deductions from employee earnings and seeing to it the best amount of money is supplied to the government, based on the most recent pay-roll tax obligation guidelines and guidelines.

Employee Benefits Solutions Seal Beach, CA

ADP mobile solutions give employees access to their pay-roll information and benefits, no matter where they are. Workers can complete a range of tasks, such as view their pay stubs, handle their time and presence, and enter time-off requests.

That's why several employers transform to pay-roll service companies for automated remedies and compliance know-how. A pay-roll service may still be of assistance.

Processing pay-roll in numerous states requires monitoring, understanding and abiding by the tax regulations and regulations in all states where you have staff members. You might likewise require to register your service in those states even if you don't have a physical area. Discover more about multi-state conformity If you're doing pay-roll manually now and plan to switch over to a pay-roll company, you should expect to reduce the moment you devote to the process.

ADP supplies pay-roll services for businesses of all dimensions tiny, midsized and huge. We also accommodate many sectors, including building, production, retail, healthcare and more. ADP's payroll services are automated, making it simple for you to run payroll. Right here are several of the vital steps to the process that we'll handle for you behind the scenes: The overall hours worked by employees is increased by their pay prices.

Employee Benefits Brokerage Firms Seal Beach, CA

Full-service pay-roll firms file taxes in your place. Some payroll suppliers offer human resource information systems with benefits administration, hiring, and efficiency administration tools. If you only hire freelancers and specialists, think about a low-cost payroll service for 1099 workers. Payroll prices might pack tax obligation filing, year-end forms, and employee settlements right into the base cost.

A Qualified Client must be processing pay-roll with Paychex in order to receive 6 months of cost-free pay-roll services, and any unused month is not redeemable in united state money or for any type of various other entity. The Promo only uses to payroll solutions, and Qualified Clients will certainly be exclusively in charge of all costs due for solutions apart from pay-roll services.

We provide straight deposit and mobile payroll services that integrate with time and attendance monitoring. We likewise automatically determine reductions for taxes and retired life contributions, and provide skilled support to assist make certain you remain certified with all appropriate regulations and regulations. ADP assists firms manage payroll taxes by automating deductions from worker wages and making certain the best amount of cash is delivered to the government, based upon the current pay-roll tax obligation rules and regulations.

Actually, it's unbelievably easy to begin with an on the internet payroll solution and add solutions such as time and presence, HR, insurance, retirement and even more as you need them. ADP mobile solutions give workers accessibility to their pay-roll info and advantages, no issue where they are. Staff members can complete a range of jobs, such as sight their pay stubs, manage their time and attendance, and get in time-off requests.

Employee Benefits Management Solutions Seal Beach, CA

This process can be time consuming and error susceptible without the appropriate resources. That's why numerous employers turn to payroll solution suppliers for automated solutions and conformity knowledge. Companies normally aren't required to hold back tax obligations from settlements to independent contractors, which streamlines payroll processing. A pay-roll service may still be of assistance.

Handling pay-roll in numerous states requires tracking, understanding and adhering to the tax obligation laws and policies in all states where you have employees. You might likewise require to register your service in those states also if you don't have a physical place. Discover more concerning multi-state conformity If you're doing pay-roll manually currently and strategy to switch to a pay-roll provider, you ought to anticipate to reduce the time you devote to the process.

Harmony SoCal Insurance Services

Address: 2135 N Pami Circle Orange, CA 92867Phone: (714) 922-0043

Email: [email protected]

Harmony SoCal Insurance Services

We also provide to various industries, including building and construction, production, retail, healthcare and even more. ADP's pay-roll services are automated, making it simple for you to run pay-roll. Here are some of the vital steps to the procedure that we'll handle for you behind the scenes: The complete hours worked by employees is multiplied by their pay prices.

Employee Benefits Brokerage Firms Seal Beach, CAEmployee Benefits Consulting Firms Seal Beach, CA

Payroll Services Near Me Seal Beach, CA

Payroll Services For Small Businesses Seal Beach, CA

Finding A Good Local Seo Firm Seal Beach, CA

Finding A Good Local Seo Citations Seal Beach, CA

Harmony SoCal Insurance Services

Table of Contents

- – Employee Benefits Consultants Seal Beach, CA

- – Harmony SoCal Insurance Services

- – Top Employee Benefits Brokers Seal Beach, CA

- – Employee Benefits Broker Near Me Seal Beach, CA

- – Employee Benefits Brokerage Firms Seal Beach, CA

- – Employee Benefits Outsourcing Companies Seal ...

- – Key Man Disability Insurance Seal Beach, CA

- – Employee Benefits Solutions Seal Beach, CA

- – Employee Benefits Brokerage Firms Seal Beach...

- – Employee Benefits Management Solutions Seal ...

- – Harmony SoCal Insurance Services

Latest Posts

Altadena Ac Repair Company

Hvac Technician Panorama City

Payroll Service Small Business Buena Park

More

Latest Posts

Altadena Ac Repair Company

Hvac Technician Panorama City

Payroll Service Small Business Buena Park